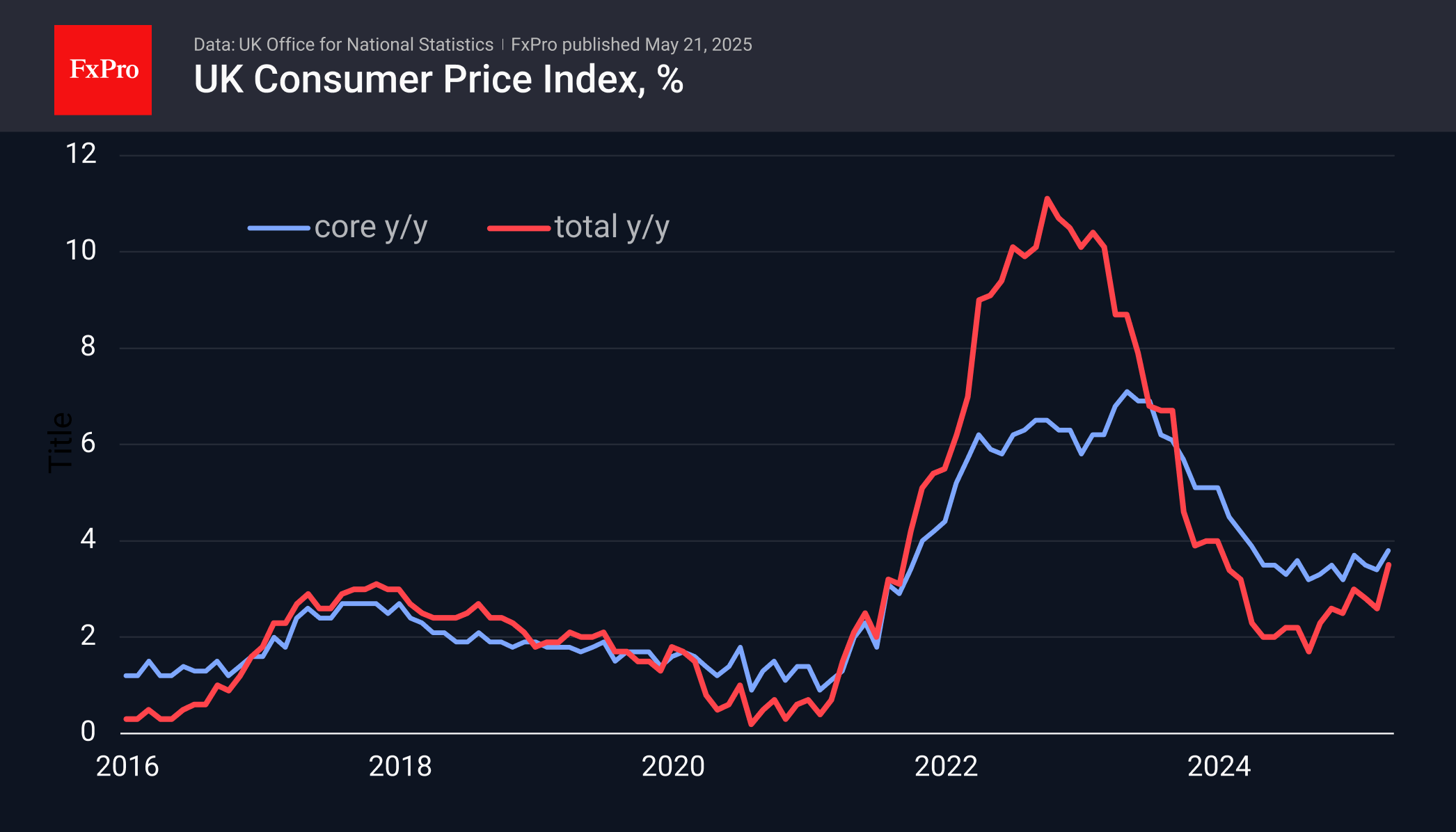

UK inflation stayed at 3.8% in August 2025, unchanged from July, keeping pressure on households and businesses as living costs remain high.

The Bank of England decided to hold its base interest rate at 4.0% during its latest policy meeting. Most committee members voted in favor of maintaining the current rate, while a small minority argued for a cut to support growth.

The main driver of higher prices continues to be food and everyday essentials, which have risen at a faster pace than many other goods. Although core inflation—which excludes volatile items such as food and energy—eased slightly, it remains above the central bank’s target.

The Bank signaled that it would slow down its bond-selling program to avoid adding unnecessary pressure on markets. Policymakers also warned that bringing inflation back to the 2% target will take time, and that risks remain from wage growth and global energy prices.

Looking ahead, analysts expect inflation could edge higher in the short term before gradually falling later in the year. The next interest rate decision is due in November 2025, when the central bank will review new data and update its outlook.

For households, this means mortgage costs and loan repayments will stay largely unchanged for now. However, the rising price of groceries and household bills continues to strain budgets across the UK.